Indian pharmaceutical companies will not sustain the healthy operating performance

reported during first quarter (1Q) of FY21. However, with global unlocking, both operational expenses and active pharmaceutical ingredient (API) prices would normalise, says a research note.

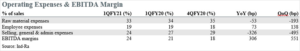

In the report, India Ratings and Research (Ind-Ra) says, “The healthy performance during 1QFY21 is attributed to the strong revenue growth in the API business and lower operating expenses. The API business revenue grew 31% year-on-year (yoy) and 18% quarter-on-quarter (qoq) in 1QFY21, as demand from global and Indian formulation players remained robust, aided by higher pricing opportunities. The restricted movement of medical representatives and other cost savings due to the lockdown led to the operating expenses declining 8% yoy and 19% qoq in the quarter, aiding profitability.”

According to the ratings agency, during 1Q, the performance of pharma companies was muted in key geographies. The key formulation business in India and US reported qoq revenue decline during 1QFY21.

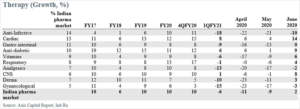

Ind-Ra says, “The India business was impacted due to a sharp decline witnessed in the acute therapy portfolio while the chronic segment continued to see moderate growth, led by a continued demand for cardiac and anti-diabetic products. The US business was affected by channel filling during 4QFY20 and patients staying away from hospitals and clinics due to COVID-19, which resulted in the qoq decline in revenue growth.”

As the unlock phase gains momentum globally and in India, Ind-Ra says it expects a quarterly revenue improvement in these businesses. The analysis is based on 14 large pharma companies and basis the segmental results reported by these companies.

According to the ratings agency, API business supported growth for pharma compaies in India and the growth rates are likely to see moderation. It says, “The strong growth in the API business was primarily attributable to the export business. Indian API players benefited due to the thrust on supply chain continuity from customers and better inventory management in view of supply disruptions from China and the run up in the prices of API. There was an element of channel stocking as well, supporting growth.”

Customers procurement strategies, however, are now gradually being recalibrated and as they are looking at gradually diversifying their procurement sources away from China or seeking alternative sources for the same API, Ind-Ra says, adding, “Price sensitivity among formulation players seems to be lowering, as ensuring availability has taken a precedence over price in view of the threat of supply chain disruptions.”

While these factors will play out over the medium to long term, Ind-Ra says it expects the growth in the API business to taper off in the near term, as companies normalise their buying patterns. Ind-Ra also expects the price correction to play a role, as the sudden demand had led to prices of some APIs’ increasing significantly which Ind-Ra expects to normalise.

Ind-Ra says its analysis highlights the decline in the operating expenses was primarily led by the 19% qoq decline in the selling expenses, which were lower during the 1QFY21 due to the curtailed travel costs and promotional expenses amid the lockdown.

While companies have communicated to Ind-Ra that a significant proportion of savings is sustainable with the use of digital tools to reach out to internal and external customers, the ratings agency says it opines otherwise, as competitive pressures may lead companies eventually reverting to in-person engagement with prescribers.

Ind-Ra says it believes most companies have used this quarter to shave off the excess costs through manpower rationalisation and expense curtailment, which could be sustainable; but, the overall sustainable cost reduction is unlikely to exceed 10%-20%.

“The quarterly raw material expense reduction seen has been a function of the strong profitability seen in the API businesses and limited price erosion seen in the US business. Gross margins also benefited from the price hike taken in the India formulations business to pass on the impact of higher API prices in the non-DPCO (drug price control order) products,” it says.

Despite a strong increase in API prices from China, raw material expenses were not impacted because of the pass-through mechanism available with the Indian pharma players catering to international markets, aided by currency benefits.

As the availability and pricing of API normalises, the profitability impact will no longer be an issue, Ind-Ra says.

“While a decline was observed in 1QFY21 across most therapies, cardiac and anti-diabetic therapies grew by 8% yoy and 6% yoy, respectively, because of a continued demand. Chronic therapies (cardiac, anti-diabetic) witnessed highest growth,” the ratings agency concludes.

Average Rating