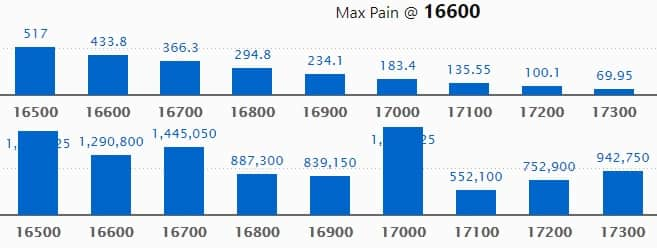

The market started off the week on a solid note and continued its uptrend for the second consecutive session of the September series, ending at another record-closing high on August 30. All sectoral indices, barring IT, participated in the run with Bank, Metal, Pharma, and Auto being the leader with a 1.7-2.5 percent rally.The BSE Sensex surged 765.04 points or 1.36 percent to 56,889.76, while the Nifty50 jumped 225.80 points or 1.35 percent to 16,931 and formed a bullish candle on the daily charts.”The daily price action has formed a sizable bullish candle registering a new high at 16,951 levels. The next higher levels to be watched are around 17,000 levels. Any sustainable move above 17,000 levels may cause momentum towards 17,100-17,200 levels,” said Rajesh Palviya, VP – Technical and Derivative Research at Axis Securities.On the downside, “any violation of an intraday support zone of 16,900 levels may cause profit booking towards 16,850-16,800 levels, he added.The broader markets also joined the party with the Nifty Midcap 100 index rising 1.94 percent and Smallcap climbing 1.53 percent.We have collated 15 data points to help you spot profitable trades:Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the NiftyAccording to pivot charts, the key support levels for the Nifty are placed at 16,813.43, followed by 16,695.77. If the index moves up, the key resistance levels to watch out for are 17,000.13 and 17,069.17.Nifty BankThe Nifty Bank outpaced the frontline indices, climbing 719.90 points or 2.02 percent to 36,347.70 on August 30. The important pivot level, which will act as crucial support for the index, is placed at 35,913.53, followed by 35,479.46. On the upside, key resistance levels are placed at 36,590.03 and 36,832.46 levels.Call option dataMaximum Call open interest of 18.73 lakh contracts was seen at 17,000 strike, which will act as a crucial resistance level in the September series.This is followed by 16,500 strike, which holds 17.96 lakh contracts, and 16,700 strike, which has accumulated 14.45 lakh contracts.Call writing was seen at 17,400 strike, which added 5.63 lakh contracts, followed by 17,300 strike, which added 4.96 lakh contracts, and 17,500 strike which added 3.73 lakh contracts.Call unwinding was seen at 16700 strike, which shed 2.3 lakh contracts, followed by 16500 strike, which shed 1.10 lakh contracts, and 16600 strike which shed 1.07 lakh contracts.

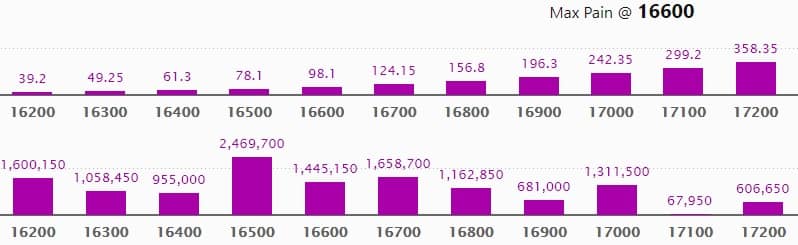

Put option dataMaximum Put open interest of 24.69 lakh contracts was seen at 16,500 strike, which will act as a crucial support level in the September series.This is followed by 16,700 strike, which holds 16.58 lakh contracts, and 16,200 strike, which has accumulated 16 lakh contracts.Put writing was seen at 16,800 strike, which added 6.86 lakh contracts, followed by 16,200 strike which added 4.26 lakh contracts, and 16,900 strike which added 3.98 lakh contracts.Put unwinding was seen at 16,500 strike, which shed 84,150 contracts, followed by 16,600 strike which shed 29,250 contracts.

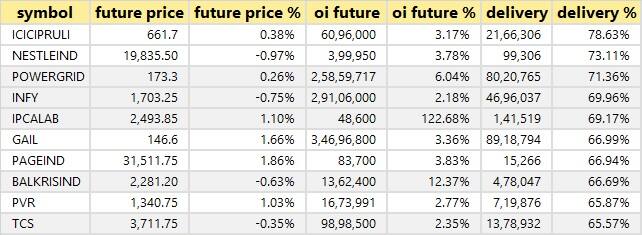

Stocks with a high delivery percentageA high delivery percentage suggests that investors are showing interest in these stocks.

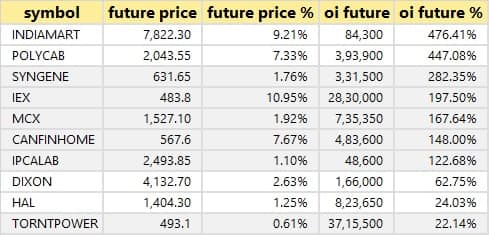

98 stocks saw long build-upAn increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

5 stocks saw long unwindingA decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the five stocks in which long unwinding was seen.

12 stocks saw short build-upAn increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

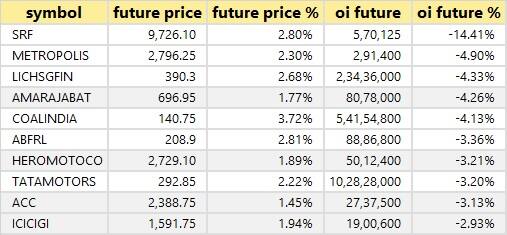

59 stocks witnessed short-coveringA decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

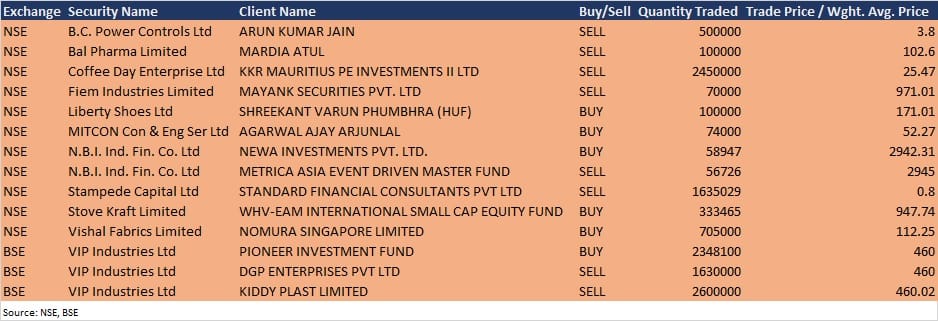

Bulk dealsCoffee Day Enterprises: KKR Mauritius PE Investments II sold 24.50 lakh equity shares in the company at Rs 25.47 per share on the NSE, the bulk deal data showed.Stove Kraft: WHV-EAM International Small Cap Equity Fund acquired 3,33,465 equity shares in the company at Rs 947.74 per share on the NSE, the bulk deals data showed.Vishal Fabrics: Nomura Singapore bought 7.05 lakh equity shares in the company at Rs 112.25 per share on the NSE, the bulk deals data showed.VIP Industries: Pioneer Investment Fund bought 23,48,100 equity shares in the company at Rs 460 per share on the BSE. However, promoter entities DGP Enterprises sold 16.30 lakh equity shares at Rs 460 per share, and Kiddy Plast offloaded 26 lakh shares at Rs 460.02 per share, the bulk deals data showed.

Average Rating